$255 Payday Loans Online Same Day - An Overview

Wiki Article

Little Known Questions About $255 Payday Loans Online Same Day.

Table of ContentsAn Unbiased View of $255 Payday Loans Online Same DayAn Unbiased View of $255 Payday Loans Online Same Day$255 Payday Loans Online Same Day for DummiesThe smart Trick of $255 Payday Loans Online Same Day That Nobody is DiscussingThe Basic Principles Of $255 Payday Loans Online Same Day

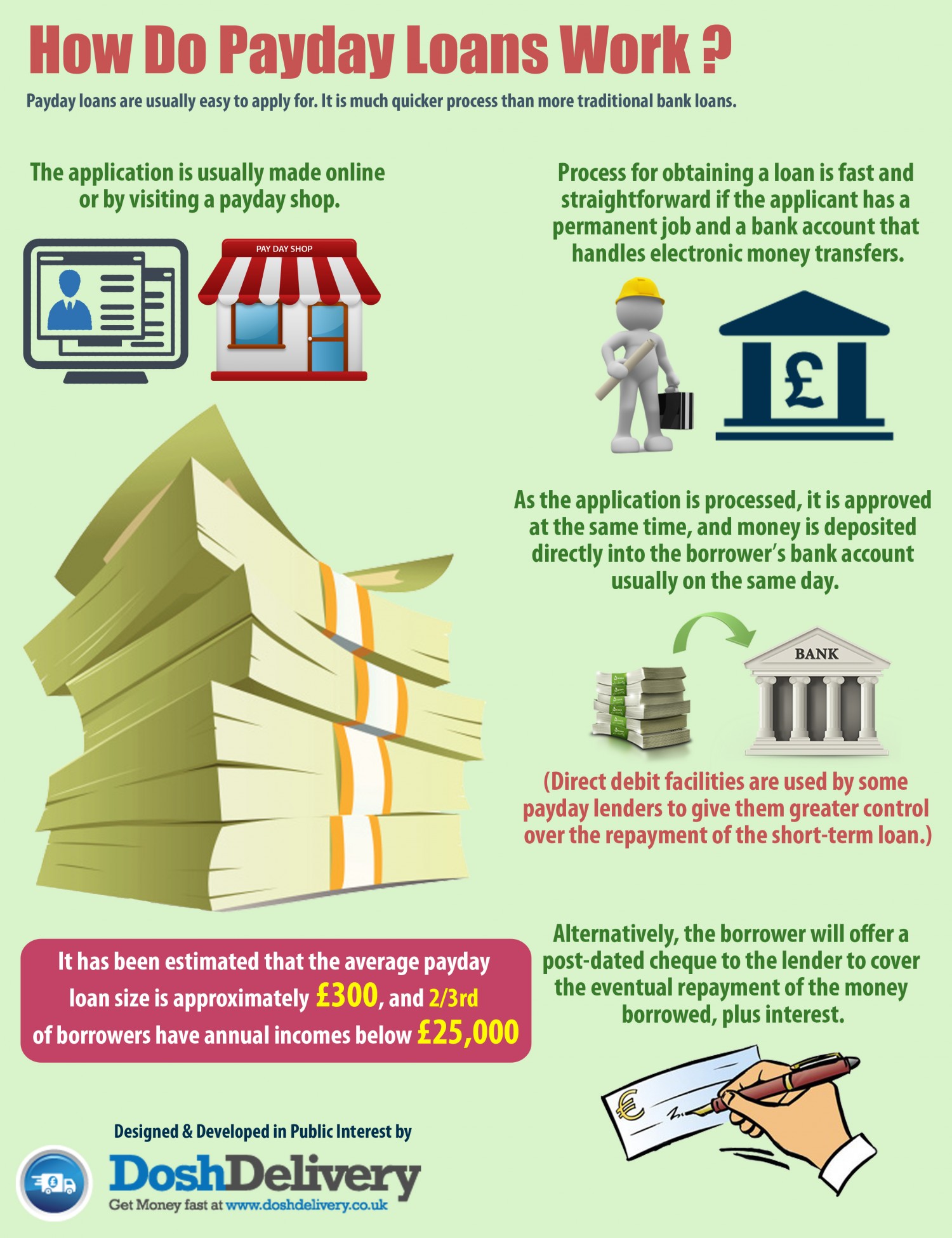

Payday fundings are short-term money car loans based upon the debtor's personal check held for future down payment or on electronic accessibility to the borrower's checking account. Customers write an individual check for the quantity borrowed plus the money fee and get cash. Sometimes, debtors transfer digital accessibility to their financial institution accounts to obtain and pay back payday advance loan.To pay a car loan, consumers can redeem the check by paying the funding with cash, enable the check to be transferred at the bank, or just pay the financing cost to roll the lending over for one more pay duration. Some payday loan providers additionally offer longer-term payday instalment financings as well as demand authorization to online take out multiple settlements from the debtor's savings account, commonly due on each pay day.

The average loan term is regarding two weeks. Loans commonly set you back 400% annual passion (APR) or much more. The money charge ranges from $15 to $30 to obtain $100. For two-week lendings, these money fees lead to rate of interest from 390 to 780% APR. Shorter term loans have even greater APRs.

All a consumer requires to get a payday advance is an open savings account in relatively great standing, a consistent income, and also recognition. Lenders do not conduct a complete credit history check or ask inquiries to determine if a consumer can afford to pay off the lending. Given that fundings are made based upon the lender's capability to accumulate, not the customer's ability to pay off while satisfying various other financial responsibilities, cash advance fundings create a financial obligation catch.

Indicators on $255 Payday Loans Online Same Day You Should Know

Consumers default on one in five cash advance. On the internet borrowers make out even worse. CFPB discovered that over half of all on the internet payday instalment car loan sequences default. Payday loans are made by cash advance stores, or at shops that offer other financial solutions, such as check cashing, title loans, rent-to-own and also pawn, relying on state licensing demands.CFPB discovered 15,766 cash advance car loan stores running in 2015. Fifteen states and also the District of Columbia safeguard their customers from high-cost cash advance loaning with practical small funding price caps or various other restrictions.

Cash advance lendings are not permitted for active-duty service participants and also their dependents. Department of Defense rules use to finances subject to the federal Truth in Lending Act, consisting of cash advance as well as title loans.

The Customer Financial Defense Bureau implements the MLA guidelines. To file an issue, click right here. See: CFA press release on revised MLA regulations.

10 Easy Facts About $255 Payday Loans Online Same Day Described

Intense yellow as well as red indications with assurances of instant money to aid you obtain to cash advance. Yupwe're talking regarding cash advance lending institutions.What you really get is a small cash advance car loan and also a stack of warm, steaming, crappy financial obligation. Payday loans are lendings that aid you obtain from one cash advance to the following (for those times your paycheck can't extend to the end of the month).

And also to top all of it off, Robert's credit report is fired, as well as all of his charge card are maxed out. Feeling desperate, Robert drives to his regional payday lender, skims the car loan contract (right past the expensive rate of interest), as well as indications his name on the populated line for $300.

In order for the loan provider to look past his settlement background (or do not have thereof) and inadequate credit rating rating, Robert needs to write a check dated for his next cash advance in the quantity he borrowedplus interest. What he doesn't understand is that by signing up to obtain cash quickly, he just made a gent's agreement with the debt evil one.

Some Ideas on $255 Payday Loans Online Same Day You Should Know

At a 15% rate of interest price for a two-week financing duration, he racked up $45 in passion. He could not pay it back in 2 weeks, so find out here now he determined to expand the lending (for one more fee of program).At the end of the cycle, Robert will certainly have just obtained $300 yet paid $105 in passion and also fees to the loan provider. That's 35% interesta 912. 50% yearly rates of interest. Yikes. Listen up: Payday lenders are the financial market's additional info mobsters. They provide an option to deal with a trouble. Yet right when you assume you're out of the woods, they come knockingthey desire their cash.

You see, when you register for a payday advance, you give the loan provider accessibility to your checking account so they can subtract what they're owed (plus a fee) on paydayor you have to write them a post-dated check.1 That's exactly how they recognize you benefit the money. Cash advance lending institutions don't in fact care whether you can pay your bills or otherwise.

As well as to top it all off, Robert's debt is fired, and also all of his charge card are maxed out. Feeling desperate, Robert drives to his local cash advance lending institution, skims the financing agreement (best past the astronomical rate of interest), as well as indicators his name on the populated line for $300 ($255 Payday loans online same day).

A Biased View of $255 Payday Loans Online Same Day

In order for the lender to look past his payment history (or lack thereof) and poor credit rating, Robert needs to create a check dated for his next payday in the quantity he borrowedplus passion. But what he does not realize is that by signing up to get money fast, he simply made a gentleman's arrangement with the financial obligation adversary.At a 15% passion rate for a two-week car loan period, he racked up $45 in passion. He couldn't pay it back in two weeks, so he decided to extend the car loan (for another charge of program).

At the end of the cycle, Robert will have just borrowed $300 but paid $105 in passion as well as charges to the lending institution. 50% yearly rate of interest price. Listen click over here up: Payday loan providers are the economic industry's mobsters.

You see, when you sign up for a payday advance, you provide the lending institution accessibility to your checking account so they can deduct what they're owed (plus a charge) on paydayor you need to create them a post-dated check.1 That's how they know you benefit the cash. Payday lenders don't in fact care whether you can pay your bills or otherwise.

Report this wiki page